OUR PROCESS

Our Process

through clarity, confidence and structure.

Clarity

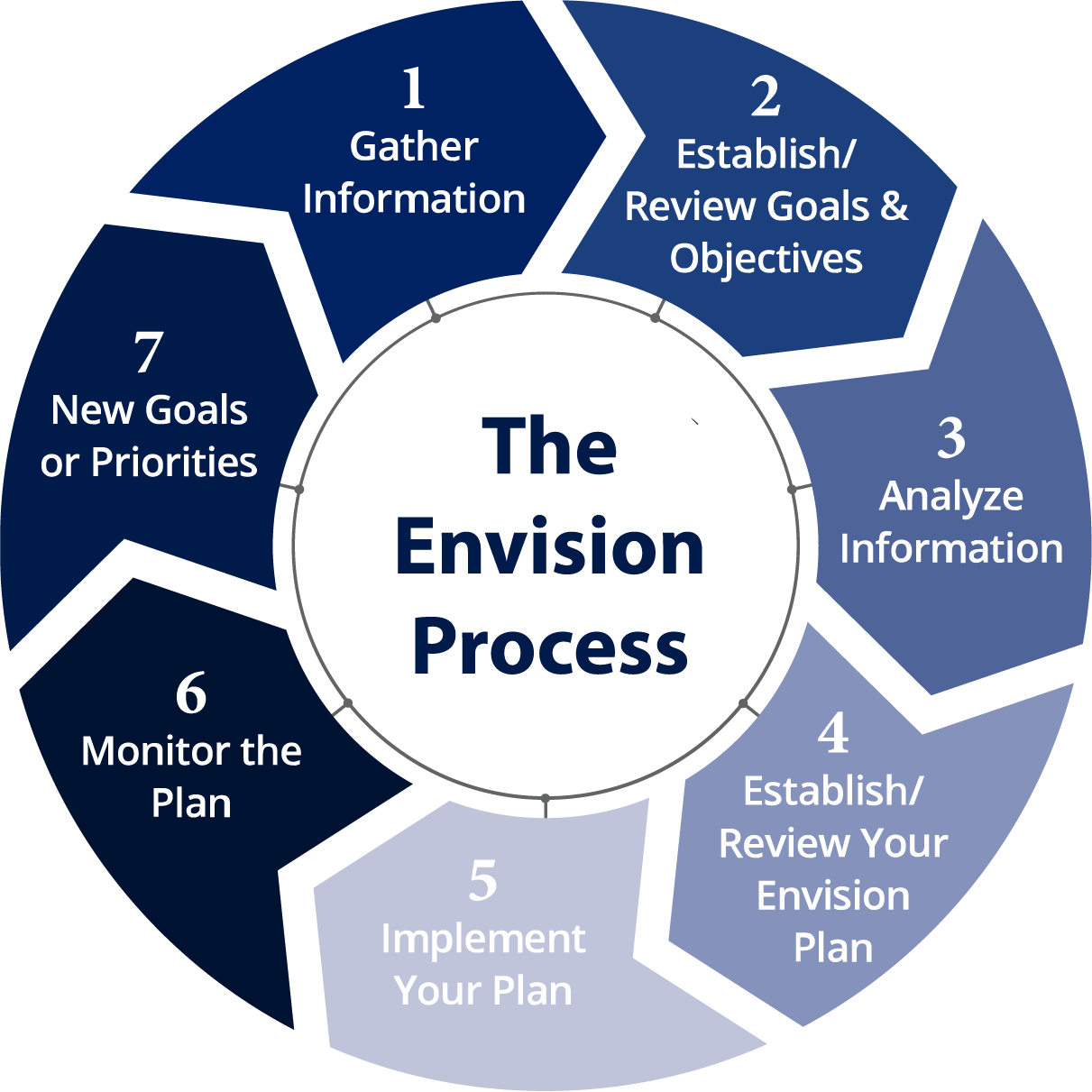

At Boyer Ramey Wealth Management Group, we utilize a detailed Investment Process to develop a deeper, more personal understanding of:

- You

- Your Passions

- Goals

- Fears

- Objectives

- Priorities

- Financial Circumstances

- Family Situation

By diving deeply into these essential questions, our partners who hold the CERTIFIED FINANCIAL PLANNER™ professional designation can help you develop a plan to focus on what you truly value most.

Confidence

Our primary objective is to help you work to maximize your portfolio's performance while working to minimize your risk exposure. Every investor is different, and our team will develop and implement a comprehensive wealth management plan tailored specifically to your unique needs.

Structure

We believe flexibility and follow up meetings are critical to the long-term success of any wealth management plan. Once we have designed and implemented your plan, we will schedule follow up meetings with our team to review your progress and discuss any changes in your life, priorities, or goals so we can make adjustments as necessary to help keep you on track.

No Obligation Investment Review

Schedule a meeting with our team to review your existing investment strategy and discover if your plan truly aligns with your long-term goals.